The MSP 119 form serves as an application for individuals seeking assistance with their Medical Services Plan (MSP) premiums in British Columbia, covering both Regular Premium Assistance and Supplementary Benefits. It requires applicants to provide comprehensive personal and financial information, including income details verified by the Canada Revenue Agency, to assess eligibility for premium support. If you believe you qualify for this assistance, don't hesitate to complete and submit your MSP 119 form today by clicking the button below.

Download PDF

Securing healthcare affordability is a task that demands thorough guidance, especially when navigating through applications for financial assistance. The Medical Services Plan (MSP) Application for Regular Premium Assistance via form MSP 119 stands as a beacon for residents in British Columbia seeking financial relief on medical premiums and supplementary benefits. This comprehensive form invites applicants to present personal details, including legal names, personal health numbers, and extensive income information, which must align with records from the Canada Revenue Agency (CRA). Designed with precision, the form intricately breaks down income brackets and corresponding deductions, providing clear pathways for individuals and families to calculate their eligibility for assistance. Beyond its primary role in facilitating regular premium assistance, the completeness of the MSP 119 form opens doors to other income-based programs, thus underscoring its significance in bolstering healthcare accessibility. With options for both regular and temporary assistance, the form serves as a critical tool for managing healthcare expenses, further enhanced by seamless online submission processes. By gathering applicant signatures and ensuring consent for income verification, MSP 119 maintains the integrity of the application process, ensuring that aid reaches those genuinely in need. Therefore, understanding every aspect of this form is paramount for residents aiming to navigate the complexities of healthcare premiums in a way that aligns with their financial reality.

| Question | Answer |

|---|---|

| Form Name | Msp 119 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | premium assistance bc, msp premium assistance application bc, british columbia premium assistance, bc msp premium assistance |

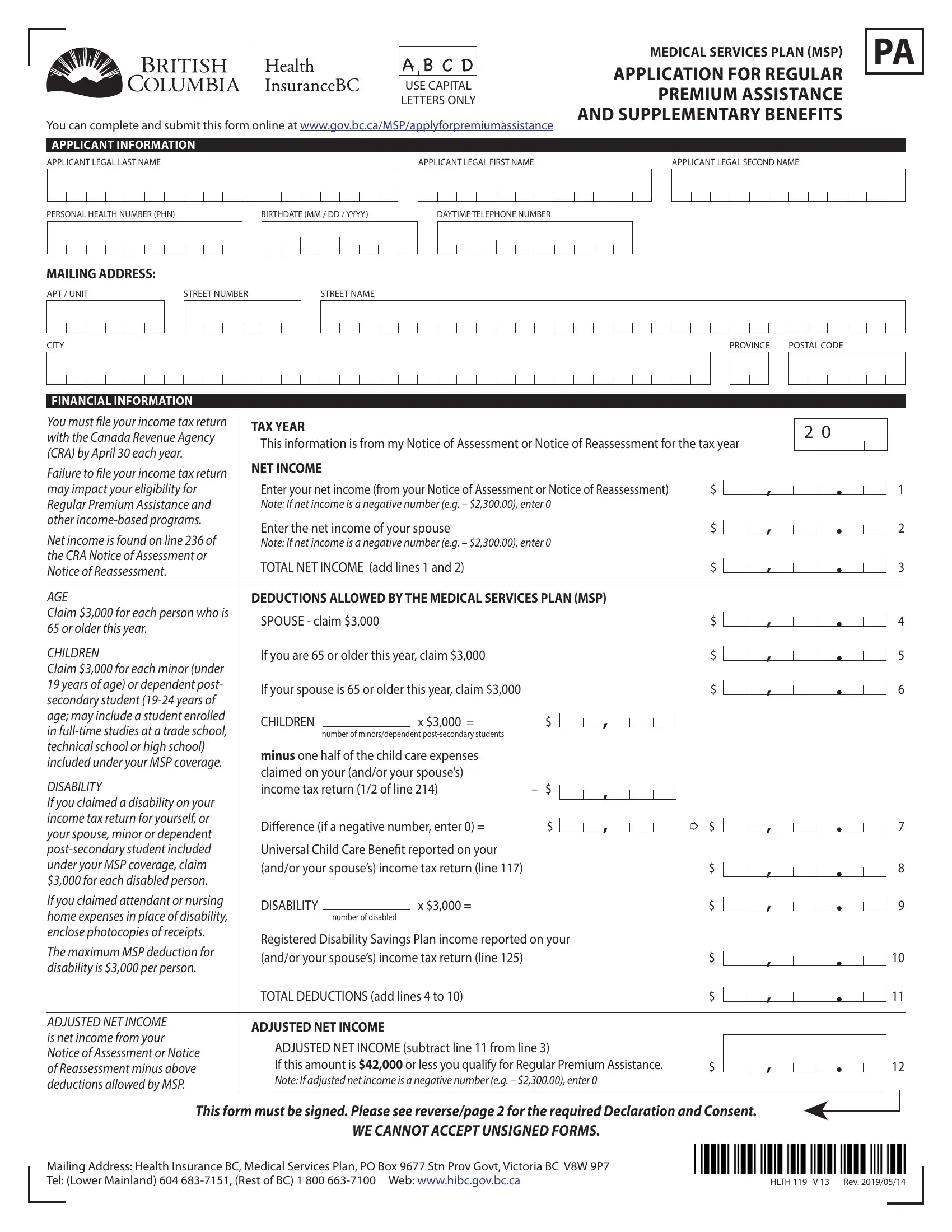

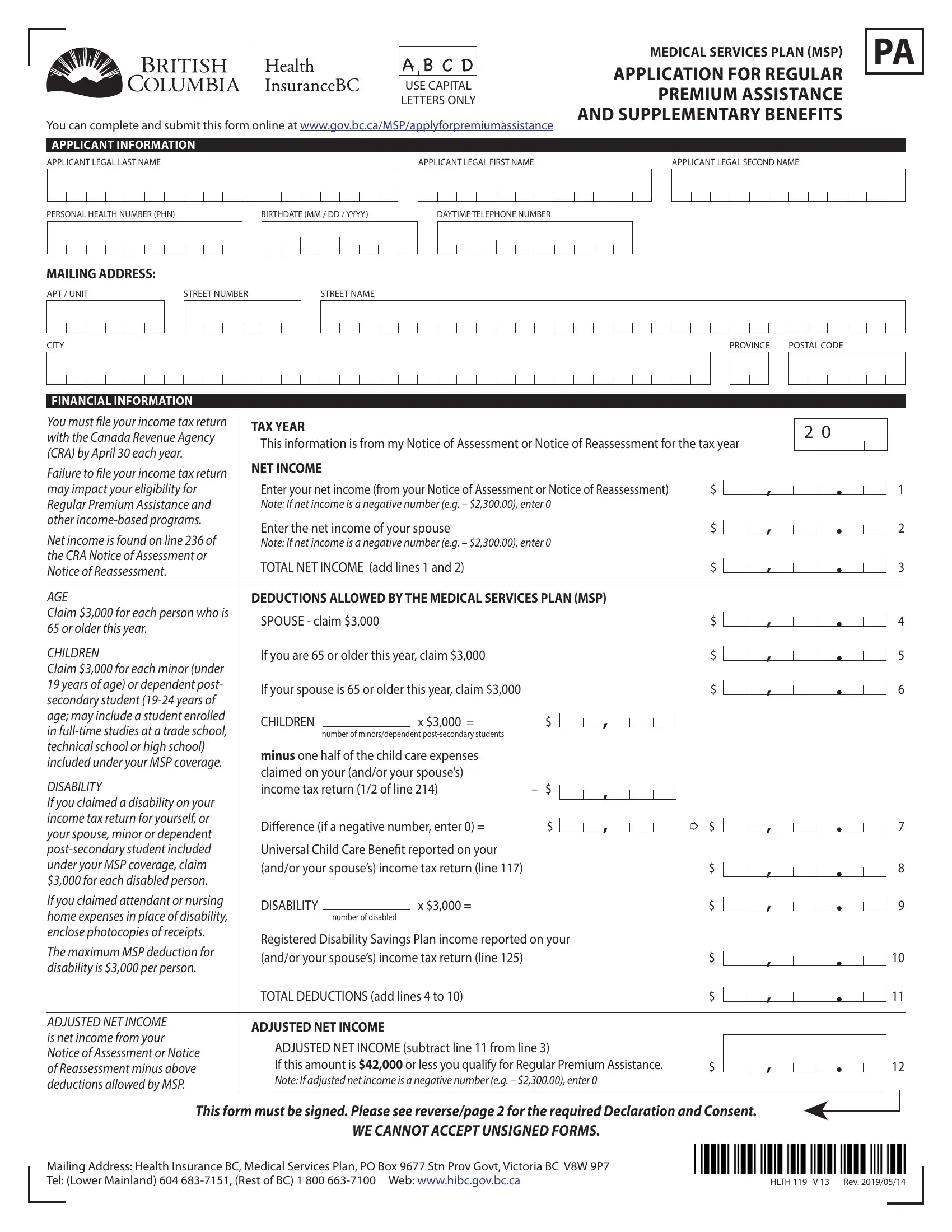

MEDICAL SERVICES PLAN (MSP)

APPLICATION FOR REGULAR

AND SUPPLEMENTARY BENEFITS

You can complete and submit this form online at www.gov.bc.ca/MSP/applyforpremiumassistance

APPLICANT LEGAL LAST NAME

APPLICANT LEGAL FIRST NAME

APPLICANT LEGAL SECOND NAME

PERSONAL HEALTH NUMBER (PHN)

BIRTHDATE (MM / DD / YYYY)

DAYTIME TELEPHONE NUMBER

You must file your income tax return

with the Canada Revenue Agency

This information is from my Notice of Assessment or Notice of Reassessment for the tax year

(CRA) by April 30 each year.

Failure to file your income tax return

may impact your eligibility for

Enter your net income (from your Notice of Assessment or Notice of Reassessment)

Regular Premium Assistance and

Note: If net income is a negative number (e.g. – $2,300.00), enter 0

Enter the net income of your spouse

Net income is found on line 236 of

Note: If net income is a negative number (e.g. – $2,300.00), enter 0

the CRA Notice of Assessment or

TOTAL NET INCOME (add lines 1 and 2)

Notice of Reassessment.

DEDUCTIONS ALLOWED BY THE MEDICAL SERVICES PLAN (MSP)

Claim $3,000 for each person who is

SPOUSE - claim $3,000

65 or older this year.

If you are 65 or older this year, claim $3,000

Claim $3,000 for each minor (under

19 years of age) or dependent post-

If your spouse is 65 or older this year, claim $3,000

secondary student years of

age; may include a student enrolled

in studies at a trade school,

number of minors/dependent students

technical school or high school)

minus one half of the child care expenses

included under your MSP coverage.

claimed on your (and/or your spouse’s)

income tax return (1/2 of line 214)

If you claimed a disability on your

income tax return for yourself, or

Difference (if a negative number, enter 0) =

your spouse, minor or dependent

Universal Child Care Benefit reported on your

under your MSP coverage, claim

(and/or your spouse’s) income tax return (line 117)

$3,000 for each disabled person.

If you claimed attendant or nursing

home expenses in place of disability,

number of disabled

enclose photocopies of receipts.

Registered Disability Savings Plan income reported on your

The maximum MSP deduction for

(and/or your spouse’s) income tax return (line 125)

disability is $3,000 per person.

TOTAL DEDUCTIONS (add lines 4 to 10)

ADJUSTED NET INCOME

ADJUSTED NET INCOME

is net income from your

ADJUSTED NET INCOME (subtract line 11 from line 3)

Notice of Assessment or Notice

If this amount is $42,000 or less you qualify for Regular Premium Assistance.

of Reassessment minus above

deductions allowed by MSP.

Note: If adjusted net income is a negative number (e.g. – $2,300.00), enter 0

This form must be signed. Please see reverse/page 2 for the required Declaration and Consent.

WE CANNOT ACCEPT UNSIGNED FORMS.

Mailing Address: Health Insurance BC, Medical Services Plan, PO Box 9677 Stn Prov Govt, Victoria BC V8W 9P7

Tel: (Lower Mainland) 604 (Rest of BC) 1 800 Web: www.hibc.gov.bc.ca

HLTH 119 V 13 Rev. 2019/05/14

DECLARATION AND CONSENT - MUST BE SIGNED

Mark ( X ) if someone has Power of Attorney or another legal representation agreement and is signing on your behalf, and include a copy of the agreement with your application.

I hereby consent to the release of information from my income tax returns, and other taxpayer information, by the Canada Revenue Agency to the Ministry of Health and/or Health Insurance BC. The information obtained will be relevant to and used for the purpose of determining and verifying my initial and ongoing entitlement to the Premium Assistance Program and the Supplementary Benefits Program under the Medicare Protection Act , and will not be disclosed to any other party. This authorization is valid for the taxation year prior to the signature of this application, the year of the signature and for each subsequent consecutive taxation year for which premium assistance and supplementary benefits is requested. It may be revoked by sending a written notice to Health Insurance BC.

I am a resident of British Columbia as defined by the Medicare Protection Act .

I have resided in Canada as a Canadian citizen or holder of permanent resident status (landed immigrant) for at least the last 12 months immediately preceding this application. I am not exempt from liability to pay income tax by reason of any other Act.

Mark ( X ) if you are married or living and cohabiting in a relationship (even if your spouse is not covered under your MSP account) and include his/her information with your application. Failure to update your MSP account if you marry or begin living in a relationship may impact eligibility for

Regular Premium Assistance.

DATE SIGNED (MM / DD / YYYY)

APPLICANT FIRST INITIAL AND LAST NAME

APPLICANT SOCIAL INSURANCE NUMBER

SPOUSE FIRST INITIAL AND LAST NAME

SPOUSE SOCIAL INSURANCE NUMBER

SPOUSE PERSONAL HEALTH NUMBER (PHN)

GROUP AUTHORIZATION (if required)

AUTHORIZATION NAME OR STAMP

MEDICAL SERVICES PLAN (MSP) PREMIUM ASSISTANCE INFORMATION

MSP enrolment must be complete for you (and your spouse, if applicable) to qualify for Regular Premium Assistance. To complete MSP enrolment, submit the MSP Application for Enrolment form and obtain a Photo BC Services Card by visiting an Insurance Corporation of BC (ICBC) driver licensing office. To find an ICBC driver licensing office near you, please visit www.icbc.com .

Types of Assistance - Two types of assistance are available:

1. Regular Premium Assistance – offered if your adjusted net income for the previous year is $42,000 or less. To apply for Regular Premium Assistance you must fully complete this form and sign the declaration and consent. If you are married or living in a relationship, your spouse must also sign. If you are covered through your employer, pension or union welfare plan , your group administrator will need to complete the Group Authorization section above.

2. Temporary Premium Assistance – offered if you are unable to pay premiums because of a current, unexpected financial hardship. To qualify, you need to provide information that shows you are unable to pay your premiums and could not have reasonably budgeted to do so. For more information, visit: www.gov.bc.ca/temporarypremiumassistance .

Other Benefits - Your application may be used to determine eligibility for other programs: Supplementary Benefits, BC Emergency Health Services, and Healthy Kids. For more information, visit www.gov.bc.ca/premiumassistance .

Fair PharmaCare - Helps BC residents with eligible costs of prescriptions and certain medical supplies. For more information or to register, visit www.gov.bc.ca/pharmacare or contact Health Insurance BC.

Income Verification - The signed declaration above allows the Ministry of Health and/or Health Insurance BC to verify your income information with the Canada Revenue Agency (CRA) on an ongoing basis. In most cases, you do not need to reapply for Regular Premium Assistance as Health Insurance BC will continue to verify your income with CRA each year and will maintain or adjust your level of assistance based on the information received from CRA. In order to verify your income, the name and date of birth on your MSP account must match the information on file at CRA.

Monthly Rates - Once you have completed the application form, look at line 12 to determine your adjusted net income. Find your adjusted net income in the premium rate table to determine your monthly rate. The rates listed below are subject to change.

PREMIUM RATE EFFECTIVE JANUARY 1, 2018

ADJUSTED NET INCOME

Two Adults in a Family

Personal information is collected under the authority of the Medicare Protection Act and section 26 (a), (c) and (e) of the Freedom of Information and Protection of Privacy Act for the purposes of administration of the Medical Services Plan. If you have any questions about the collection and use of your personal information, please contact the Health Insurance BC Chief Privacy Office at Health Insurance BC, Chief Privacy Office, PO Box 9035 STN PROV GOVT, Victoria, BC V8W 9E3 or call 604 (Vancouver) or

HLTH 119 PAGE 2

hlth 119 can be filled out online easily. Simply try FormsPal PDF editor to perform the job promptly. To retain our tool on the cutting edge of practicality, we strive to put into action user-oriented features and enhancements on a regular basis. We're at all times looking for suggestions - join us in reshaping the way you work with PDF docs. With some simple steps, you are able to start your PDF journey:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: Using our online PDF editor, you may accomplish more than simply fill out blanks. Express yourself and make your docs look professional with custom text added in, or modify the file's original input to perfection - all comes along with the capability to insert just about any photos and sign the document off.

This form will require specific details to be typed in, hence be sure you take some time to provide exactly what is required:

1. The hlth 119 necessitates certain information to be inserted. Ensure that the next blank fields are complete:

2. Once your current task is complete, take the next step – fill out all of these fields - AGE Claim for each person who is, CHILDREN Claim for each minor, DISABILITY If you claimed a, If you claimed attendant or, The maximum MSP deduction for, ADJUSTED NET INCOME is net income, DEDUCTIONS ALLOWED BY THE MEDICAL, SPOUSE claim, If you are or older this year, If your spouse is or older this, CHILDREN, number of minorsdependent, minus one half of the child care, Difference if a negative number, and Universal Child Care Benefit with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

As for The maximum MSP deduction for and If you claimed attendant or, be sure that you get them right here. Both of these are surely the most significant ones in this form.

3. Completing DECLARATION AND CONSENT MUST BE, Mark X if someone has Power of, I hereby consent to the release of, I am a resident of British, I have resided in Canada as a, Mark X if you are married or, APPLICANT SIGNATURE, SPOUSE SIGNATURE, DATE SIGNED MM DD YYYY, APPLICANT FIRST INITIAL AND LAST, SPOUSE FIRST INITIAL AND LAST NAME, APPLICANT SOCIAL INSURANCE NUMBER, SPOUSE SOCIAL INSURANCE NUMBER, SPOUSE PERSONAL HEALTH NUMBER PHN, and GROUP AUTHORIZATION if required is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: After double-checking the filled out blanks, hit "Done" and you are done and dusted! Get your hlth 119 once you sign up at FormsPal for a free trial. Conveniently view the pdf form in your FormsPal cabinet, with any modifications and changes being automatically synced! We don't share or sell any information you type in when working with documents at our site.